Crypto 30x : Tips And Insights To Spot High-Growth Cryptos

- November 24, 2023

These last days we have seen growing speculation of an impending bull market, fueled by the upcoming Bitcoin halving and recent news from investors like BlackRock’s ETF. The market has seen prices soar, this is why the pursuit of a crypto 30x growth potential become increasingly coveted. In so doing, understanding how to identify high-growth potential in cryptocurrencies is crucial. We are currently at the brink of a potential surge in cryptocurrency value. This article is designed to navigate you through the market’s complexities, spotlighting opportunities for significant growth.

Table of contents

- Understanding the Crypto Landscape

- Key Indicators to Spot a Crypto 30x Growth Potential

- Harnessing Innovation and Compliance for Crypto 30x Growth

- Choosing a Profitable Cryptos to Mine

- Investment Strategies for Crypto Enthusiasts

- Staying Ahead: Tools and Resources

- Frequently Asked Questions

- Conclusion

Understanding the Crypto Landscape

Navigating the crypto world can feel like exploring a vast, ever-changing galaxy. At its heart, Bitcoin, the original cryptocurrency, continues to reign supreme. Its enduring dominance and market capitalization, which has reached $750 billion as of the end of november 2023, speak for itself. While Bitcoin remains a dominant force, don’t overlook the rising stars in the crypto world. Altcoins like Ethereum with its dApps, Cardano’s eco-friendly algorithm, and emerging Real World Assets projects (RWA) are making more and more impact on the industry.

The initial craze around decentralization, the mad rush of crypto-currency enthusiasts and investors in Non-Fungible Tokens (NFTs). The health of certain tokens and assets often depends on the buzz they generate within the community and the industry.

Anticipating spotting the next crypto 30x isn’t just about picking a winner. It’s about understanding the shifts, the technology, and the community backing each project. It’s a thrilling ride, and for those who keep their fingers on the pulse, the rewards can be astronomical. Stay tuned, stay informed, and who knows? You might just find your crypto goldmine.

Key Indicators to Spot a Crypto 30x Growth Potential

In the hunt for the next crypto 30x, savvy investors and miners know that it’s not just about jumping on any bandwagon. Identifying cryptos with high-growth potential requires a keen eye for certain key indicators. First up, let’s talk about innovation and real-world application and tokenomics. Cryptos that solve real problems or bring novel solutions to the table are often poised for growth. It’s not for nothing that Ethereum is the second mastodon after Bitcoin. Its introduction of smart contracts revolutionized the blockchain space.

Another crucial factor is the strength and activity of the community behind a cryptocurrency. Dogecoin’s growth is propelled by its vibrant community and high-profile supporters like Tesla and X/Twitter CEO Elon Musk. Additionally, partnerships and corporate backing can lend credibility and resources, boosting a crypto’s growth prospects.

- Market capitalization and liquidity are also telling. While high market cap cryptos are generally considered safer bets, lower cap coins can offer higher growth potential, albeit with increased risk.

- Volume traded in the last 24 hours can reflect market interest, strong market engagement or reactions to recent events.

- Circulating supply reveals how many coins are publicly available, impacting scarcity and potential demand. Together, these metrics provide a comprehensive view of a cryptocurrency’s market position, helping to assess its growth potential and investment viability.

- Lastly, don’t overlook the regulatory environment. Changes in regulations can significantly impact a crypto’s potential. Staying informed about global regulatory trends is crucial. Hester Peirce, the SEC commissioner, recently said to Bloomberg that the SEC needs to do better regulating crypto.

Spotting a potential crypto 30x growth is a mix of technical analysis, market trends, and a bit of intuition. It’s about seeing the diamond in the rough before it shines.

Harnessing Innovation and Compliance for Crypto 30x Growth

In the fast-paced realm of cryptocurrency, identifying projects with a strong potential for a Crypto 30x returns requires a keen eye on technological innovation and regulatory compliance. Projects at the forefront of blockchain technology that offer scalable, private, and interoperable solutions present groundbreaking opportunities for growth. Equally important is a project’s adherence to evolving regulatory standards, which not only mitigates risk but also enhances its legitimacy and appeal to a broader investor base. Focusing on these critical aspects can uncover cryptos that are not just promising in terms of technology but are also prepared for the regulatory future, marking them as prime candidates for substantial returns.

As cryptocurrencies and blockchain technologies mature, the regulatory environment becomes increasingly crucial. Recent approvals by regulatory bodies, such as the Securities and Exchange Commission (SEC), for blockchain-based financial products, highlight a growing acceptance and understanding of digital currencies within the formal financial ecosystem. The integration of central bank digital currencies (CBDCs) and the development of regulatory frameworks around them further illustrate the potential for blockchain technologies to integrate with traditional financial systems, enhancing their legitimacy and growth potential.

Choosing a Profitable Cryptos to Mine

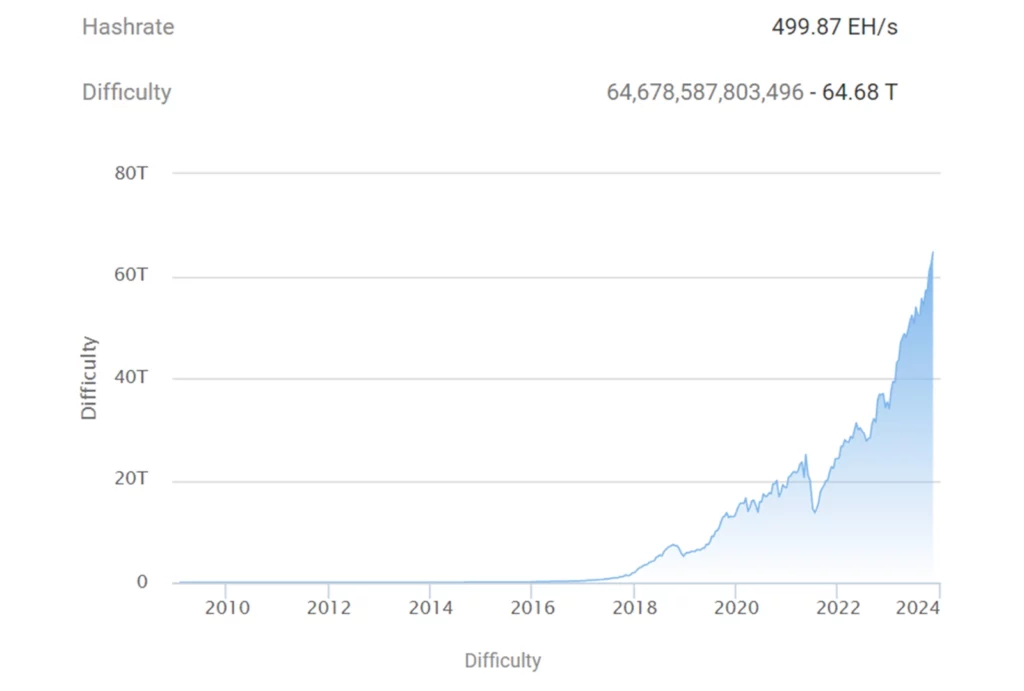

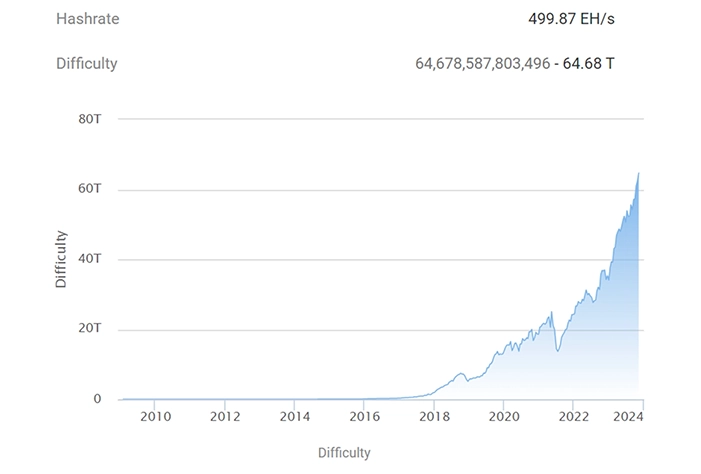

In the quest for crypto 30x, mining remains a cornerstone. But it’s not just about firing up any rig and watching the coins roll in. The art of profitable crypto mining hinges on a strategic choice of currency. Bitcoin, the granddaddy of them all, might seem like an obvious pick. However, its increasing mining difficulty and the need for specialized, high-cost equipment make it a tough nut to crack for individual miners. This difficulty is all the more acute during bullrun periods, when many more people are competing to mine.

Enter altcoins still offers a more accessible mining landscape. But don’t just jump on the first altcoin you see. Consider factors like network hash rate, block rewards, and the overall stability of the coin. The PoW produced in the last 24h could also be a hint on the popularity of a coin in the crypto mining landscape. For example, coins like Kaspa, Dogecoin or even Ethereum Classic have carved out their niches with relatively lower barriers to entry and consistent community support.

It’s not all about the coin’s current value; it’s about the potential for growth. Look for projects with strong development teams, clear roadmaps, and active communities. These are signs of a healthy ecosystem that can support long-term growth – the kind that might just lead to that elusive crypto 30x. Remember, in the world of crypto mining, it’s as much about the journey as it is about the destination. Choose wisely, mine efficiently, and the rewards could be substantial.

Investment Strategies for Crypto Enthusiasts

For those dreaming of a crypto 30x returns, savvy investment strategies are key. A golden rule in the crypto world is diversification. Don’t put all your eggs in one basket; spread your investments across various cryptocurrencies. This approach balances the risk across high-cap stalwarts like Bitcoin and Ethereum, and potentially high-growth altcoins.

- Another strategy gaining traction is Dollar-Cost Averaging (DCA). This involves investing a fixed amount into a particular cryptocurrency at regular intervals, regardless of its price. This method can help mitigate the risks of market volatility, a common characteristic of the crypto market. By averaging out the purchase price over time, investors can potentially lower the impact of a bad entry point.

- Long-term holding, or ‘HODLing’, is another popular strategy. It’s based on the belief that despite short-term market fluctuations, the value of robust cryptocurrencies will increase over the long term. This strategy requires patience and a strong belief in your chosen cryptocurrencies’ fundamentals.

- Lastly, staying informed is crucial. Regularly following crypto news, market trends, and technological advancements can provide insights for timely and informed investment decisions. Remember, knowledge is power, especially in the dynamic world of cryptocurrency.

In summary, combining diversification, DCA, long-term holding, and staying informed creates a robust strategy for those looking to capitalize on the potential of crypto 30x. Remember, the crypto market is unpredictable, so invest wisely and within your means.

Staying Ahead: Tools and Resources

In the fast-paced world of cryptocurrency, staying ahead of the curve is crucial for anyone eyeing opportunities of a crypto 30x. Thankfully, there’s a plethora of tools and resources at your disposal. For real-time market data, CoinMarketCap and CoinGecko are invaluable. They provide comprehensive price charts, market cap information, and historical data, helping you make informed decisions.

Staying updated with the latest news and trends is also critical. Websites like Cointelegraph and Decrypt offer daily news, analysis, and opinion pieces, keeping you in the loop with the ever-evolving crypto landscape.

Lastly, don’t underestimate the power of community. Forums like Reddit’s r/CryptoCurrency and online groups provide a platform for discussion, advice, and insights from fellow enthusiasts and experts.

By leveraging these tools and resources, you’ll be well-equipped to navigate the crypto market and identify those crypto 30x potentials. Remember, knowledge is as valuable as your investment in this dynamic domain.

Frequently asked questions

A bullrun in the cryptocurrency world refers to a period of sharp price increases on the crypto market, characterized by widespread optimism and a significant rise in the value of digital currencies. During a bullrun, investor interest and confidence in the market increase, often leading to a rapid and sustained rise in the prices of various cryptocurrencies.

Crypto 30x refers to cryptocurrencies with the potential to grow 30 times their current value, offering high returns for miners and investors.

Look for strong community support, innovative technology, tokenomics and real-world applications. Market capitalization, liquidity and exchanged volum in the last 24h are also key indicators.

Diversify your portfolio, understand the risks, and stay informed about market trends and news.

Follow crypto news on sites like Cointelegraph and Decrypt, as well as community forums. Use tools and resources like CoinMarketCap or CoinGecko.

Conclusion

Identifying the next crypto 30x requires a blend of technical knowledge, market insight, and a keen eye for emerging trends. Whether you’re mining or investing, staying informed and adaptable is key. Remember, the crypto world is volatile, but with the right strategies and tools, the potential for significant growth is real. Embrace the journey, and may your crypto endeavors be fruitful!

We hope this article will be helpful for you. If so, make sure to follow us on X, Discord and Telegram. If you are looking for a stable and reliable crypto mining pool, start mining now on Cruxpool!