Crypto Compliance: How to Report your Mining Taxes?

Being sure to respect crypto compliance is crucial for any business involved in cryptocurrency mining. As a mining pool, we know that it could be challenging to have all these technical information in mind. So if you’re not sure how to report your crypto mining taxes, you are in the right place. In this guide, we’ll break down how you can report your mining gains, losses, and income in just 6 easy steps!

Article by Dhiraj Nallapaneni, Crypto Tax Writer at Coinledger.io

Table of contents

1. Grasping crypto compliance in your tax obligations

The first step is understanding how cryptocurrency mining is taxed. Generally, cryptocurrency is subject to income tax and capital gains tax in the United States. The same rules apply to cryptocurrency mining.

When you earn cryptocurrency, you’ll recognize income based on the fair market value of your mined crypto at the time of receipt.

When you dispose of your crypto, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

To better understand how income and capital gains are taxed, let’s take a look at an example.

- Trevor’s business mines $500 of BTC.

- Later, the business sells the BTC for $600.

- Trevor’s business recognizes $500 of income and $100 of capital gain.

2. Business or Hobby? Determine your mining operations

Remember, you don’t need to have a business entity set up to have your mining operation be taxed as a business. So be careful about your crypto compliance.

According to the IRS, 9 factors are used to determine whether your mining operation is a business or a hobby, including:

- Whether you operate your mining operation in a ‘businesslike manner,’ which may include keeping accurate books and records

- Whether you depend on income from your mining operation for your livelihood.

- Whether the time and effort you put into your mining operations indicate you intend to make it profitable.

3. Keep detailed records for crypto compliance

Keeping detailed records will help you accurately calculate your mining income and expenses for tax purposes.

It is essential to keep track of all mining income, including any rewards or fees earned from mining pools. You should also keep track of all expenses associated with mining, such as equipment costs, electricity bills, and any other related fees.

You should also keep a transaction history of all of your cryptocurrency disposals. This will help you accurately calculate capital gains or losses from the sale or exchange of cryptocurrency.

If you’re having trouble determining your income and capital gains, you can use a crypto tax software like Coinledger to connect to your cryptocurrency wallets and automatically calculate your tax liability for you.

Finally, it is important to keep your records up-to-date and organized. This will help ensure you have all the necessary information ready when it comes time to file your tax return for your crypto compliance. Keeping detailed records can be time-consuming, but it is well worth the effort in the long run to avoid any potential issues with the IRS.

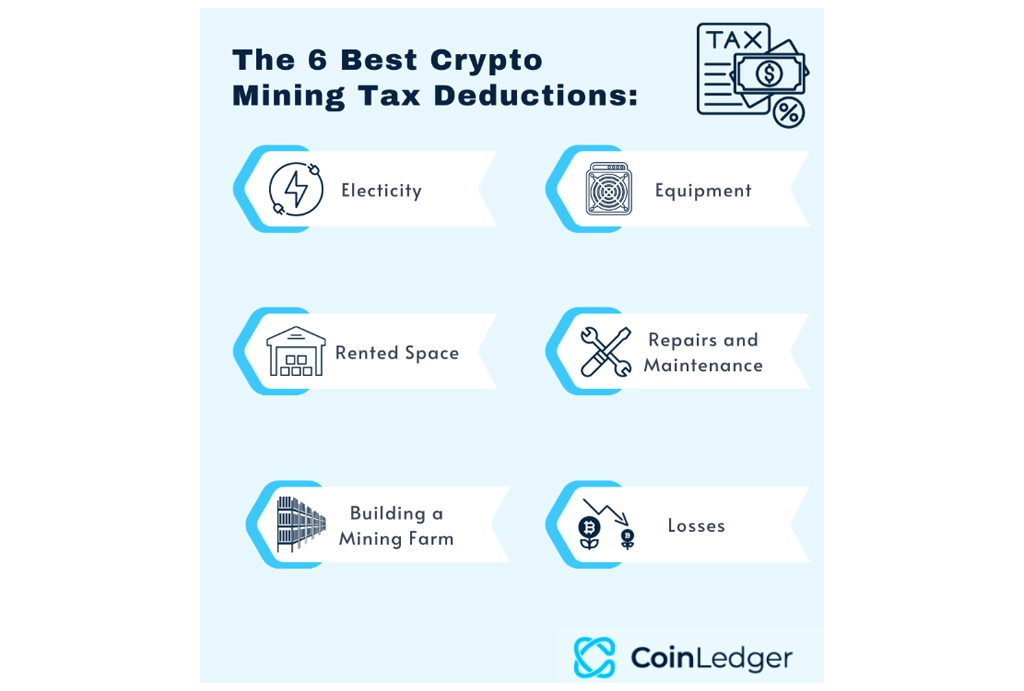

4. Deduct your allowable expenses

Once you have determined your income and capital gains, you must subtract any mining expenses, such as equipment costs or electricity bills, from your gross mining income to find your net mining income. This net income is what you will report on your tax return.

If you’re mining cryptocurrency as a business, you can deduct allowable expenses related to your mining activities. These expenses may include:

- Electricity bills

- Mining equipment

- Maintenance and repairs of equipment

- Rented space

- Building a mining farm

- The losses from setting up your crypto mining business

By deducting allowable expenses, you can reduce your taxable income and lower your tax liability by deducting allowable expenses. However, you can only deduct expenses that are considered ordinary and necessary in the course of cryptocurrency mining.

Additionally, if you’re claiming depreciation on the cost of your mining equipment, you’ll need to use Form 4562 to calculate your depreciation deduction.

5. Filling out the right tax forms

Once you’ve calculated your income and expenses, it’s time to report your income, capital gains, and expenses on your tax report.

6. Pay your taxes

Once you’ve completed all the other steps, you’re ready to pay your taxes! The total amount that you owe will vary based on the structure of your business.

If your business is set up as a sole proprietorship or a flow-through entity, you’ll pay the individual crypto tax rate on your income and capital gains. You’ll pay the federal corporate tax rate if your business is set up as a corporation.

To pay your taxes on your mining income, you can either make a one-time payment when you file your tax return or make quarterly estimated tax payments throughout the year.

If you expect to owe more than $1,000 in taxes on your mining income, you may be required to make quarterly estimated tax payments.

If you’re unsure how much you owe or how to make a payment, consult with a tax professional or the IRS for guidance.

Frequently askes questions

Yes, if you want to mine cryptocurrency as a business, you need to report your mining income on your tax return. Relevant expenses can be deducted from your income. If you’re mining cryptocurrency as a hobby, you can’t deduct expenses.

Yes, you need to pay taxes on mined cryptocurrencies, even if you haven’t sold them yet. Mining rewards from cryptocurrency are considered income upon receipt and subject to income tax.

Many cryptocurrency mining businesses have a net loss during their first year of operations. A net loss can reduce your tax liability! If you have a net loss for the year, you can use your loss to deduct income from other sources or offset gains in future tax years.

Conclusion

Proper tax reporting is crucial for the crypto compliance of crypto mining businesses. By keeping accurate records of your income and expenses and taking advantage of all available tax deductions, you can reduce your tax liability and avoid penalties and interest charges from the IRS.

For more expert guide, make sure to follow Cruxpool on X, Discord and Telegram. To start mining easily and quickly, join one of our mining pools.