What is a mining pool and how does it work?

Mining is crucial when it comes to securing Proof of Work blockchains. By calculating hashes, participants secure crypto networks. For those who do not know yet, a hash is a series of numbers and letters generated by a cryptographic hash function.

When Bitcoin was first launched, back in 2009, it was quite simple to mine. Anyone could mine with a basic computer and compete with other miners to solve equations.

Today, mining Bitcoin has become very difficult.

In a mining pool, miners are working together and rewards are split between them.

Mining pools are the best place to start a mining activity, especially if your computing power is quite low.

Mining pools give miners the opportunity to bring their computing power together in order to get steady rewards. Miners get rewarded depending on their contribution to the network.

By joining a mining pool, miners increase their chance to mine a block.

But what is the exact definition of a mining pool? How does it work? In this article, you will learn everything you need to know from mechanics to pros and cons of mining pools.

What is a mining pool?

Why were mining pools created?

As previously mentioned, mining Bitcoin or other major cryptocurrencies is not easy. The ever growing adoption of Bitcoin has led to an incredible rise of competition between miners.

That is why mining a block on your own is very difficult. It is almost impossible for an average miner to get rewards. Companies found answers to this issue and components have evolved.

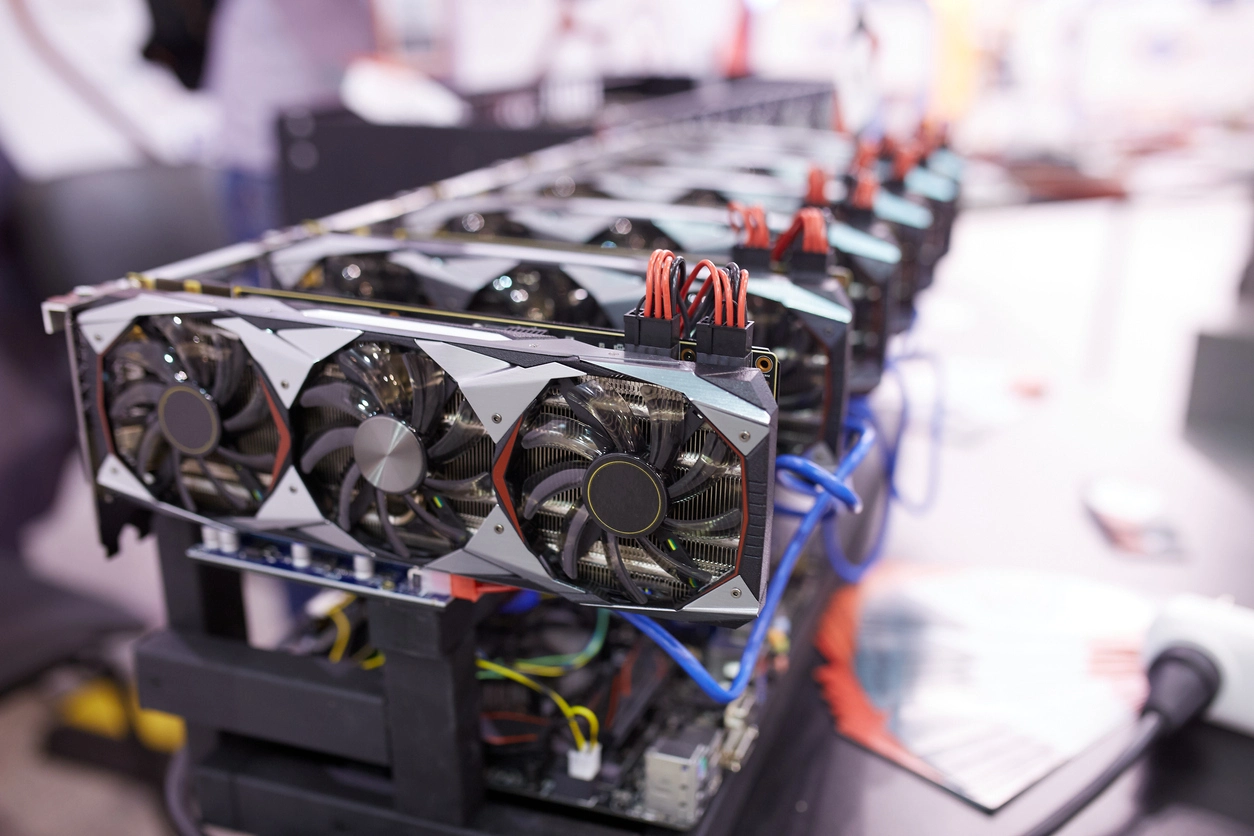

At the beginning, mining was profitable with a few cards or even a single one. ASICs were made to answer the increase of difficulty on the network. ASICs (Application-Specific Integrated Circuits) are specialized mining computers and are optimized to solve mining algorithms.

ASICs have turned Bitcoin mining into an industry and the use of less powerful computers is now uncommon.

It is important to note that only the first miner that finds a block gets the rewards.

Other miners get to mine new blocks and do not get any kind of rewards for their previous tries. Mining pools were created to face Bitcoin mining increasing difficulty.

The massive adoption of cryptocurrencies led to an energy consumption growth. For example, Bitcoin’s carbon footprint is huge and the costs are high. That is why miners, and particularly bigger ones, are used to relocate in areas where electricity is more affordable, even if it means a higher climate impact.

Of course, other cryptocurrencies like Ethereum use a PoW algorithm and are still profitable for GPU/Average miners. It is also possible to use mining rigs. Mining rigs are kind of hybrid computers, designed specifically for mining. By connecting mining rigs to the network, miners take part in the validation process called Proof of Work and secure the network and the transactions sent by users.

There is a huge range of mining components. Do not worry, there are plenty of solutions to start mining!

What is the definition of a mining pool?

Solo mining has become difficult and rarely profitable (in a steady way at least). This is where mining pools come into play.

A mining pool is a group of cryptocurrency miners that combine their computational effort to solve mathematical problems required by the blockchain in PoW based networks.

If you are looking for a way to generate steady revenue, mining pools should fit perfectly.

In a mining pool, you will be able to team up with other miners, regardless of your computational power. You will then be able to find several blocks per day thanks to the other miners of the pool and your contribution. Your contribution will determine how much of the reward you will be getting when a block is found by the pool.

Major features of a mining pool

There are some major features you need to consider about a mining pool.

Hashrate

Hashrate is an indicator measuring the hashing power per second on a Proof Of Work based blockchain. Hashrate is a very important factor.

The higher the hashrate of the pool, the easier it is to mine a block and then to have a better or faster return on investment.

Reward distribution modes

There are various reward distribution modes such as : PPS, PPLNS or FPPS.

It refers to distribution modes used by the pools to give back the rewards to their miners. You will find more details on these a little further in the article.

Transaction fees

There are two major kinds of fees applied when mining. First, there are transaction fees when a pool sends their rewards to miners. Transaction fees’ amount is set by the network but the pool chooses the reward distribution system and frequency. The pool chooses how much they charge and keep from the mining activity. You should note that those are paid by Cruxpool for Ethereum Layer 2 and other coins!

For example, PPLNS has lower fees while PPS has higher ones because mining pools have to pay for the effort brought by miners whether the blocks are found or not.

Withdrawal

There are many ways to keep and store your mining rewards : wallets, web extensions or exchanges’ wallets. There are sometimes specific wallets for smaller networks/coins, you should check compatibility before getting started. Trust Wallet, Exodus, Metamask are wallets that support the most commonly used cryptocurrencies.

How does a mining pool work?

Transactions are validated and secured by miners. Mining is used to avoid double spending, which is basically printing money from scratch.

Miners’ computers work as transaction validators, these transactions are structured in blocks. Thereby, when a block is found, it is added to the previous blocks, forming the blockchain. Miners are rewarded by the network for their contribution.

Miners support the activity on Proof of Work networks. Furthermore, the need for miners to combine their effort within mining pools has never been so great. Chances of finding a block mining on your own are thin due to the increase of the network’s difficulty and competition on the network.

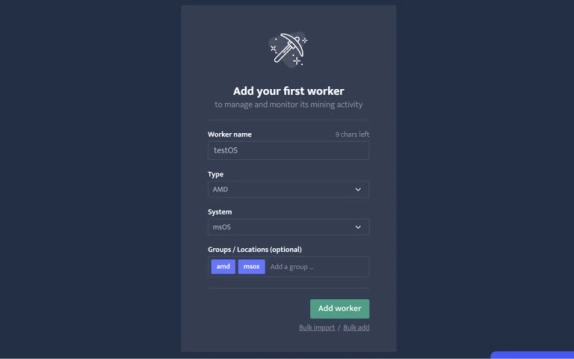

When a miner joins a pool, he has to connect his rig and software to the pool’s servers.

To sum it up, a share is a hash used to keep a track on miners’ work.

The mining pool accepts the connection and starts transmitting key information such as mining difficulty that the miner will be facing when mining.

Let’s take an example :

Imagine, there is 1 miner (let’s call him Axel) and 99 other miners have 0,01% of the total network hashrate. On average, Axel could only be able to find a single block out of 10 000. Averaging 144 blocks found on a random network, Axel could either find a block every 10 weeks or nothing at all. If Axel is unlucky, he might not find any blocks for 20 or 50 weeks in a row. The problem is that Axel should still be profitable at least to cover electricity fees and mining equipment.

In this particular case, Axel should join a mining pool where he will team up with 99 other miners. Mining together, they will have a certain weight of the network. On 100 blocks on average, the pool could find 1 or 2 blocks per day. The reward will then be distributed proportionally to those who took part of the mining process.

What are the reward distribution systems?

Depending on each mining pool, there are reward distribution systems that are integral to the operation of the pool. They are often crucial in deciding which mining pool to choose as a miner. Indeed, it is through these different systems that miners receive their income (after deducting fees).

Pay-Per-Share (PPS)

In this system, the miner receives a fixed amount for each share. The amount paid for each share is small, but it accumulates gradually. A share is not necessarily a valid hash, because with PPS, miners are rewarded even if the block is not found.

Proportionnel (PROP)

Members receive a reward at the end of the operating period. The reward is proportional to the minor’s shares based on the total number of shares held. In addition, the reward is based on the shares accepted.

Pay-Per-Last-N-Shares (PPLNS)

PPLNS is a form of profit distribution based on the number of shares that miners bring in. If several blocks are mined, the miners will have a high profit. If the miners cannot extract the block, the miners’ profit is zero. PPLNS only rewards miners when a block is found.

In the short term, PPLNS is correlated to what is called luck. Luck represents the number of shares the mining pool needs to find a specific block compared to the average number of shares needed to find a block based on the difficulty of the network. If the mining pool has no luck, the income of all pool members decreases, but the opposite can also happen!

Pay-Per-Share+ (PPS+)

PPS+ is a mix of PPS and PPLNS. The block reward is settled according to the PPS model and the transaction fees are paid according to the PPLNS method. In this mode, miners get additional income from the transaction fees based on the PPLNS method.

With PPS+, the mining pool also pays the transaction fee that is included if a block is found.

Full-Pay-Per-Share (FPPS)

In this mode, the block reward and the mining service fee are paid according to the theoretical profit. This involves taking a standard transaction fee for a certain period of time and distributing it to miners according to their hashrate contribution. This increases the miner’s income by sharing a portion of the transaction fee.

At Cruxpool, we have adopted the FPPS and PPS models by taking 1% on block rewards.

Comparative table of reward distribution systems

Here is a chart to help you see how different reward distribution systems handle (or not) transaction fees, luck and regular payouts:

Legend: “–” means that the choice is for mining pools.

We can see that with PPS and FPPS, it is possible to receive a payment regardless of whether the pool finds a block or not. This is the biggest advantage over PPLNS.

But the miner will probably earn much more with PPLNS than with a PPS or FPPS mining pool, if he contributes to a pool with a large block.

Why you should mine with our mining pool Cruxpool?

Rewards with no transaction fees

With Cruxpool, you earn a significant portion of the rewards and pay no transaction fees for Ethereum Layer 2 and other coins.

In addition, we regularly organize promotional offers and contests to reward our miners and introduce new users to our services.

Cryptocurrencies compatible with mining

Cruxpool offers mining service. It is possible to mine different cryptocurrencies like Bitcoin, Ethereum, Ethereum Classic, Ergo, Ravencoin, Beam, Firo and others.

Transparency, independence and security

We value transparency and will always do our best to keep you informed about what is going on at Cruxpool. You can monitor your returns and manage your machines from our dashboard. You also have quick access to the hashrate of the entire mining pool.

At the same time, if you are mining with an account, 2FA guarantees you greater security and helps you avoid identity theft or impersonation.

Guaranteed payments

We will always deposit your mined earnings directly into your account. You only need to enter your public crypto wallet address when you sign up. Of course, payments are guaranteed.

An available team

How to join the Cruxpool community?

If you want to join our mining pool, you can create a Cruxpool account.

You can join Cruxpool anonymously with a crypto wallet address or register with an account. Mining directly with a username allows you to not necessarily mention your crypto wallet, but also to have a dashboard per cryptocurrency.

Thanks to this article, you will know what a mining pool is and how it works.

As you may have noticed, mining pools have made their contribution to cryptocurrency mining. Mining becomes a group activity in which there is no competition.

However, these mining pools can be seen as a threat to decentralization, the latter advocated by the cryptocurrency world. Some pools dominate the mining world due to the large number of miners they gather.

But let’s not forget that miners can change mining pools according to their needs and interests. It is still important for miners and mining pools to maintain the decentralized ecosystem to ensure profitability and security.